Washington State Legal Considerations

This unit will help you navigate the wonderful world of legal learning. Take a deep breath, it’s not nearly as scary as you may think!

Introduction

We’d like you to rethink your relationship with legal topics.

As you begin your entrepreneurship journey, you will need to navigate through state and local government agencies and obtain the proper licenses, permits, certifications, and/or registrations to conduct business with the public.

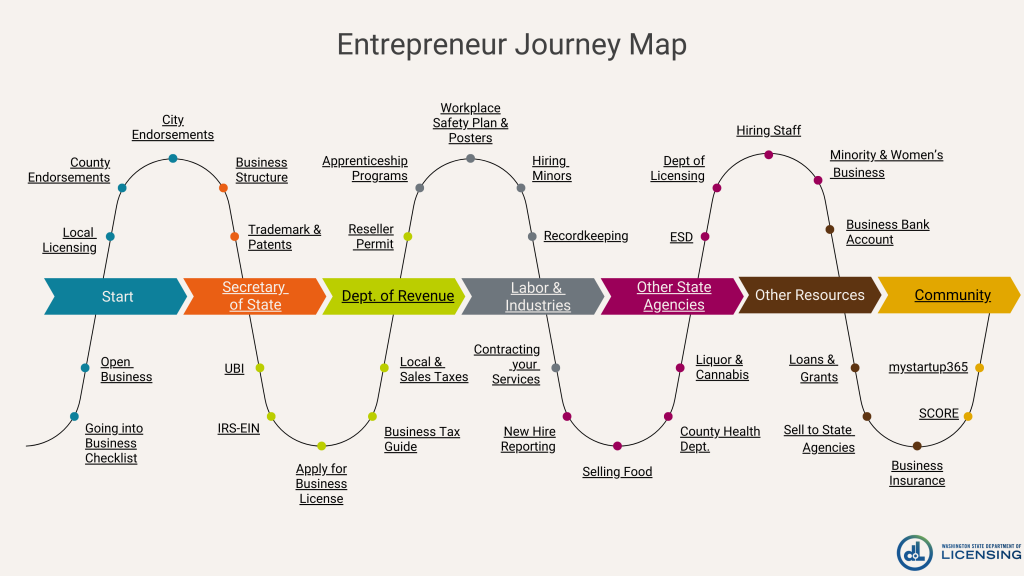

The Entrepreneur Journey Map, below, will help you navigate through all these legal pieces. This map has been designed for Washington State residents and only meets high-level requirements. We strongly encourage you to explore each link, take advantage of each website’s search tools and their AI chatbots for more specific support. Use the map to follow along the journey as the video talks through the steps.

Let's get started!

Remember, as your business grows, the legal requirements you need to meet may change. A healthy habit is to visit each agency’s website quarterly. Consider signing up for newsletters so that you have the most up to date information.

The straight path is a good place to start, but don’t forget to meander! Don’t be afraid to reach out and ask questions. Legal doesn’t have to be scary and ominous, rethink your relationship with legal, it’s there to help you on your Entrepreneurship Journey!

Click here or on the above image to launch the Entrepreneur Journey Map

Put your learning into practice:

Explore Reflection Activity #1 in the workbook.

As you begin your journey, you will find the straightforward path and its meandering companion path. The straightforward path includes the main points of contact nearly every business in Washington state must encounter to be legally compliant. The meandering companion path are other possible points of contact that you may need to connect with. At the beginning of your journey, you may not need to make all the connections on the meandering path. However, as your business grows, you’ll want to revisit the path.

In your journey, you will begin with the Internal Revenue Service (IRS) and the WA Department of Revenue (DOR). DOR has a fantastic tool, Business Licensing Wizard, that will help you discover what licenses, permits, certifications, and/or registrations, and any other documentation, you’ll need to run your business legally in Washington.

You will want to check your local government agencies, county and city, to see if there are any additional requirements that you need to meet for their jurisdictions.

Your next stop will be with the Secretary of State (SOS). Here is where you’ll find different business entities. Will you be the sole owner (sole proprietor) or maybe you’d like to set up as a limited liability company, known more commonly as an LLC. If you have a trademark that you’d like to register, you’ll do this with the SOS as well. You’ll get the opportunity to search for trademarks that are already registered so that the name of your business is uniquely yours.

Labor & Industries (LNI) offers a wide range of information, workshops, and training opportunities for your business. There’s a lot to review here, plan on spending some time learning your business requirements. They have important information from hiring employees and independent contractors, to injury claims and forms. They also have an entire safety requirements department.

Depending on your business, you may need to obtain a license, permit, certificate, or registration from multiple state agencies. Washington state has a Small Business Liaison Team (SBLT) which is made up of representatives from 29 state agencies. Their goal is to support small businesses in Washington. They have created a Checklist and Small Business Guide packed with helpful information and guides. You can also find contact information for each state agency for more help.

No business is too small to not need a license and/or permit of some kind. Consider this, selling cookies at the local farmers market requires a Cottage Permit authorized by the Department of Agriculture and a business license from the Department of Revenue. Take the time to research what your business needs to operate legally.

As you work your way through the path, you’ll want to take advantage of connecting with others in your field. Take time to meet and connect with other entrepreneurs who are in a similar business. That doesn’t necessarily mean selling the same products. Connecting with those selling similar products gives you an opportunity to learn what is currently selling well, what the market is like, new tools and systems available. Making more connections along your journey will ultimately help you begin your entrepreneurship journey.

Put your learning into practice:

Explore Reflection Activity #3 in the workbook.

Diving Deeper

US patent and trademark

Entity Name (state level)- An entity name can protect the name of your business at a state level. Depending on your business structure and location, the state may require you to register a legal entity name.

Your entity name is how the state identifies your business. Each state may have different rules about what your entity name can be and usage of company suffixes. Most states don’t allow you to register a name that’s already been registered by someone else, and some states require your entity name to reflect the kind of business it represents.

In most cases, your entity name registration protects your business and prevents anyone else in the state from operating under the same entity name. However, there are exceptions pertaining to state and business structure.

In Washington you will register your business name with the Secretary of State and the Department of Revenue.

Trademark (federal level)- A trademark can protect the name of your business, goods, and services at a national level. Trademarks prevent others in the same (or similar) industry in the United States from using your trademarked names.

For example, if you were an electronics company and wanted to call your business Springfield Electronic Accessories and one of your products Screen Cover 5000, trademarking those names would prevent other electronics businesses or similar products from using those same names.

Businesses in every state are subject to trademark infringement lawsuits, which can prove costly. That’s why you should check your prospective business, product, and service names against the official trademark database, maintained by the United States Patent and Trademark Office.

Doing Business As (DBA) (may or may not be required locally or with your industry)- You might need to register your DBA — also known as a trade name, fictitious name, or assumed name — with the state, county, or city your business is located in. Registering your DBA name doesn’t provide legal protection by itself, but most states require you to register your DBA if you use one. Some business structures require you to use a DBA.

Even if you’re not required to register a DBA, you might want to anyway. A DBA lets you conduct business under a different identity from your own personal name or your formal business entity name. As an added bonus, getting a DBA and federal tax ID number (EIN) allows you to open a business bank account.

Multiple businesses can go by the same DBA in one state, so you’re less restricted in what you can choose. There’s also more leeway in the clarity of business function. For example, a small business owner could use Springfield Electronic Accessories for their entity name but use TechBuddy for their DBA. Just remember that trademark infringement laws will still apply.

Determine your DBA requirements based on your specific location. Requirements vary by business structure as well as by state, county, and municipality, so check with local government offices and websites.

Domain Name (online business)- If you want an online presence for your business, start by registering a domain name — also known as your website address, or URL.

Once you register your domain name, no one else can use it for as long as you continue to own it. It’s a good way to protect your brand presence online.

If someone else has already registered the domain you wanted to use, that’s okay. Your domain name doesn’t actually need to be the same as your legal business name, trademark, or DBA. For example, Springfield Electronic Accessories could register the domain name techbuddyspringfield.com.

You’ll register your domain name through a registrar service. Consult a directory of accredited registrars to determine which ones are safe to use, and then pick one that offers you the best combination of price and customer service. Depending on how long you registered your domain name for, typically one to ten years, you will need to renew your domain name to ensure it remains yours. There is typically an auto-renew function. Regardless, make a habit to check each year that your domain name registration is not expired.

US Department of Treasury: Financial Crimes Enforcement Network

Beneficial Ownership Information Reporting (BOIR) – Many companies are required to report information to FinCEN about the individuals who ultimately own or control them. As of January 1, 2024, many companies in the United States will have to report information about their beneficial owners – the individuals who ultimately own or control the company. They will have to report the information to the Financial Crimes Enforcement Network. FinCEN is a bureau of the U.S. Department of the Treasury. Beneficial ownership reporting is a requirement of the Corporate Transparency Act of 2021.

Companies that are required to comply (“reporting companies”) must file their initial reports by the following deadlines:

Existing companies: Reporting companies created or registered to do business in the United States before January 1, 2024, must file by January 1, 2025.

Newly created or registered companies: Reporting companies created or registered to do business in the United States in 2024 have 90 calendar days to file after receiving actual or public notice that their company’s creation or registration is effective.

Beneficial ownership information reporting is not an annual requirement. A report only needs to be submitted once, unless the filer needs to update or correct information. Filing is simple, secure, and free of charge. Learn more about beneficial ownership information reporting at www.fincen.gov/boi

Department of Revenue

Registration requirements: You must register with the Department of Revenue and get a business license if you meet any of the following conditions:

- Your business requires city, county, and state

- You are doing business using a name other than your full legal name.

- You plan to hire employees within the next 90 days.

- You sell a product or provide a service that requires the collection of sales tax.

- Your gross income is $12,000 per year or more.

- Your business is required to pay taxes or fees to the Department of Revenue.

- You are a buyer or processor of specialty wood products.

- Your business meets Nexus threshold reporting requirements.

If you’re ready to start your business, you need to apply for your business license. Complete the Business Licensing Wizard to receive a list of agencies to contact, additional endorsements and helpful tips about your business license. When you receive your business license, you’ll be assigned a Unified Business Identifier (UBI) number. This number is unique to your business, and you’ll need it whenever you file your taxes or make changes to your business.

How to apply:

- Start a scenario: Using the Business Licensing Wizard. You will have the option to Apply Now using our secure online system, or expand the By Mail to download and complete all the forms listed.

- Apply online: Applications will take approximately 10 business days to process. If you have city or state endorsements, it may take an additional 2-3 weeks to receive your business license due to approval time. Create an online account in our secure My DOR This account will also be used to file your taxes and make changes to your business.

- By mail: Complete the Business License Application form, along with any additional forms, and payment to the address on the form. Mailed applications can take up to six weeks to process.

- The application fee: For a Business License Application varies; see instructions on how to determine your processing fee. There are additional fees for each additional endorsement. See our city, county, and state endorsements for fees and descriptions.

What happens next?

There are additional steps after your application has been processed. You’ll have to choose an ownership structure. A business is a legal entity; it can own property, hold bank accounts and is required to pay taxes. There are different types of business entities, each with unique benefits and limitations.

The right choice for you depends on your interests and needs. You should contact an attorney, accountant, financial advisor, or other business or legal advisor to determine which structure is most suitable for your business. Good decisions are based on:

- The number of current and future possible owners.

- The types of owners – are they all individuals or are they entities (such as corporations, trusts, etc.)?

- Liability concerns.

- Federal tax implications – Internal Revenue Service (IRS).

- Registration and tax filing requirements and costs.

- Paperwork and entity management considerations.

Registration requirements: You must register with the Department of Revenue and get a business license if you meet any of the following conditions:

- Your business requires city, county, and state

- You are doing business using a name other than your full name legal name.

- You plan to hire employeeswithin the next 90 days.

- You sell a product or provide a service that requires the collection of sales tax.

- Your gross income is $12,000 per year or more.

- Your business is required to pay taxes or feesto the Department of Revenue.

- You are a buyer or processor of specialty wood products.

- Your business meets Nexus thresholdreporting requirements.

If you’re ready to start your business, you need to apply for your business license. Complete the Business Licensing Wizard to receive a list of agencies to contact, additional endorsements and helpful tips about your business license. When you receive your business license, you’ll be assigned a Unified Business Identifier (UBI) number. This number is unique to your business, and you’ll need it whenever you file your taxes or make changes to your business.

How to apply:

- Start a scenario: Using the Business Licensing Wizard. You will have the option to Apply Now using our secure online system, or expand the By Mail to download and complete all the forms listed.

- Apply online: Applications will take approximately 10 business days to process. If you have city or state endorsements, it may take an additional 2-3 weeks to receive your business license due to approval time. Create an online account in our secure My DOR This account will also be used to file your taxes and make changes to your business.

- By mail: Complete the Business License Application, along with any additional forms, and payment to the address on the form. Mailed applications can take up to six weeks to process.

- The application fee: For a Business License Application varies; see instructions on how to determine your processing fee. There are additional fees for each additional endorsement. See our city, county, and state endorsements for fees and descriptions.

What happens next?

There are additional steps after your application has been processed. You’ll have to choose an ownership structure. A business is a legal entity; it can own property, hold bank accounts and is required to pay taxes. There are different types of business entities, each with unique benefits and limitations.

The right choice for you depends on your interests and needs. You should contact an attorney, accountant, financial advisor, or other business or legal advisor to determine which structure is most suitable for your business. Good decisions are based on:

- The number of current and future possible owners.

- The types of owners – are they all individuals or are they entities (such as corporations, trusts, etc.)?

- Liability concerns.

- Federal tax implications – Internal Revenue Service (IRS).

- Registration and tax filing requirements and costs.

- Paperwork and entity management considerations.

Helpful links:

- Compare business ownership structures.

- Find legal, tax and business (SCORE, Small Business Development Centers) advisors.

Business Licensing and Renewals

Employer Identification Number (EIN) – Sole proprietors who aren’t employers usually don’t have to apply for a Federal Employer Identification Number (EIN). However, all other business types must apply for this registration whether they have employees or not. For more information about who needs an EIN or how to apply, visit the Internal Revenue Service

Unified Business Identifier (UBI) – A UBI number is a nine-digit number that registers you with several state agencies and allows you to do business in Washington State. A UBI number is sometimes called a tax registration number, a business registration number, or a business license number. Use the Business License Application to apply for a UBI number.

Labor & Industries (L&I)

Typically, a business will interact with L&I only if they are hiring employees, so starting a business with only the owner in operation will not involve L&I unless they start that business with employees. (Department of Revenue bears the largest part of the starting a business process along with Secretary of State, if the business has a corporate structure and needs to be registered).

There are, however, instances, where a business would need a license, permit, or registration to start a business without employees:

- Businesses that engage in a line of work requiring contractor registration (some areas where people need contractor registration and may not know it – landscaping if performing any kind of installations, janitorial if cleaning up construction debris, “handyman” work)

- Plumbing

- Electrical

- Public works projects

- Food trucks & trailers

- Others requiring contractor registration, including elevators, boilers, cranes

L&I will be creating a roadmap of how to get the required insurances once you have an employee that will be housed on Business.wa.gov.

Resources to get you started:

If you would like guidance on forming or growing a business in Washington, with links to appropriate agencies and valuable resources, please visit the Business.wa.gov website, where you will find the Small Business Guide. In particular, the Employees section of the Grow Your Business chapter and the Payroll Your Business chapter are incredibly useful as references for employers.

Some of the most useful resources available to small businesses are the free advising services offered statewide by the Washington Small Business Development Center, which can be reached online or at 833-492-7232, and SCORE. There are also many local business support organizations you can access through the Washington Microenterprise Association.

For a variety of hiring resources including unlimited job posting and labor market information, visit WorkSourceWA.

Setting up required employer accounts:

In order to set up workers’ compensation insurance, it is necessary to update your WA state business license. If you say YES to hiring employees in your application, workers’ compensation and unemployment insurance accounts will be automatically opened. The following steps are required as an employer in the state of WA.

Update your WA state business license with the Department of Revenue/Business Licensing Service and indicate you are going to have employee(s). For customer service, call 360-705-6741.

Once the application and employee endorsement is processed, L&I (workers’ compensation) and Employment Security Department (unemployment insurance) will open up accounts for the business in 2-4 weeks. You will receive a packet in the mail from L&I with your account number, your rates, and contact information for your L&I account manager. You will also receive the required L&I workplace posters to hang in your workplace. If you have employees working remotely, you can email them PDF versions of the posters found here as well as access a list of other required federal and state posters.

When the time comes, file your workers’ compensation insurance quarterly reports online here. The due dates you need to report by are:

- April 30 for Quarter 1 (Hours worked from January 1 – March 31)

- July 31 for Quarter 2 (Hours worked from April 1 – June 30)

- October 31 for Quarter 3 (Hours worked from July 1 – September 30)

- January 31 for Quarter 4 (Hours worked from October 1 – December 31)

Other information and resources for employers

- Report all new employees (including part-time and temporary) to the Department of Social & Health Services (DSHS) New Hire Reporting Program within twenty days of hire. Reporting new hires helps the Division of Child Support collect support more efficiently.

- Create an Accident Prevention Program (required – even for remote workers). If you need help creating this, we have sample programs here or you can request a FREE, confidential consultation to get you started on the right foot.

- Provide all employees required notice of Paid Sick Leave benefits, and consider creating optional sick leave policies.

- Learn more about filing quarterly reports, reporting worker hours, and keeping other required employment records on the L&I Recordkeeping Requirements page.

- Sign up for a FREE L&I Essentials for Business webinar to understand your role, your many requirements, and what L&I does – these are offered each month as live, online webinars.

- Get questions related to other state agencies answered, such as the Department of Revenue and Employment Security, by contacting their Small Business Liaisons.

Apprenticeship

Apprenticeship Programs – Apprenticeship preparation programs help you find and prepare for registered apprenticeship opportunities. Each recognized program listed below has working relationships with one or more registered apprenticeship program sponsors.

These programs are recognized by the Washington State Apprenticeship and Training Council (WSATC) and follow standards outlined in WSATC Policy 2012-03, as amended August, 2023.

Become an Apprentice – An apprenticeship combines on-the-job training with related classroom instruction, all under the supervision of a journey-level professional. Apprentices get paid while they learn and develop knowledge, skills, and abilities in a new career field.

Secretary of State

Washington (Domestic) Corporation

Washington (Domestic) Partnership

Washington (Domestic) Liability Company

Washington (Domestic) Limited Liability Partnership

Washington (Domestic) Non-Charitable Nonprofits

IRS – Charities and Nonprofits Information

The basic information you will need to provide includes:

- Business name

- Business location

- Ownership, management structure, or directors

- Registered agent information

- Number and value of shares (if you’re a corporation)

The documents you need — and what goes in them — will vary based on your state and business structure.

Department of Licensing: Business and Professions Division

The Business and Professions Division’s primary mission is to license professionals and businesses and collect revenues. The division also has regulatory responsibilities to ensure licenses are appropriately issued and renewed, and appropriate taxes paid. The division strives to provide accessible and responsive services that strengthen public safety and consumer protection.

The division oversees licensing and regulatory activities for 34 professions and 143 license types (businesses and individuals).

Each profession/business has its own hub (List of Businesses and Professions) of resources. At the hub, one will find:

- Forms

- Instructions on how to apply/renew/reinstate your license

- Licensing fees

- News and updates

- Laws and rules

- Exam information

- Education, professional development, and/or training requirements

- Audit information

- FAQs

Board or commission information that you need to provide (if there is one for that profession):

- Board or commission mission and vision statements

- Members, their roles and term

- Meeting dates and agendas

- Meeting minutes

- Additional resources for that business or profession

- Email and phone information to contact a specialist

Fingerprinting and background checks

- List which professions require background checks

- Fees

- Where to go

- What to expect

If you have a criminal conviction, you can to determine your eligibility for certain professional licenses. DOL lists what you will need if you’re requesting a screening and the process.

Internal Revenue Service

Stay legally compliant – Federal, State, and Industry Regulations: Internal business requirements are for your own record keeping. You should document your compliance with internal requirements closely with company records. You might need them when you decide to sell your business or if a legal action is taken against your business.

Annual Filing Requirements

Tax Years – Check out IRS TAX YEARS – For detailed information as well as unit 7. You must figure your taxable income based on tax year. A “tax year” is an annual accounting period for keeping records and reporting income and expenses. An annual accounting period does not include a short tax year. The tax years you can pick from to use for your business are:

Calendar year: Twelve (12) consecutive months beginning January 1 and ending December 31.

Fiscal year; Twelve (12) consecutive months ending on the last day of any month except December. A 52-53-week tax year is a fiscal tax year that varies from 52 to 53 weeks but does not have to end on the last day of a month.

Example: HC/DC started business operations in August – planning forward for winter hot cocoa season! Rather than start our business with a “tax year” that begins in January and only shows income during a few months of the year, we decided our “fiscal year” will begin on August 1 and end on July 31 of each year.

Licenses, Permits, and Certificates (Federal, State, Local Government)

- Federal Trade Commission

- US Copyright Office

- US Department of Labor

- Occupational Safety and Health Administration (OSHA)

- US Department of Justice – American Disabilities Act

- List of License Providers by Profession

- GOV

- Small Business Guidance

- Department of Licensing Business and Professions Division

- Liquor and Cannabis Board

- Department of Agriculture

- Department of Children, Youth, and Families

- Department of Financial Institutions

- Department of Fish and Wildlife

- Department of Health

- Department of Revenue

- Department of Transportation – Aviation

- Gambling Commission

- Office of the Insurance Commissioner

- Board of Registration for Engineers and Land Surveyors

- Bar Association

- Labor and Industries

- Washington Medical Commission

Local Government

County and city governments – Typically, you don’t need to register with county or city governments to actually form your business. If your business is an LLC, corporation, partnership, or nonprofit corporation, you might need to file for licenses and permits from the county or city.

Some counties and cities also require you to register your DBA — a trade name or a fictitious name — if you use one. Local governments determine registration, licensing, and permitting requirements, so visit local government websites to find out what you need to do.

Helpful Links

Check what you learned

The Young Entrepreneur Academy unit assessment tool is available to you to help you practice what you learn. You can pause and exit at any time and take the assessment as many times as you want. We don’t collect personal information nor do we use or show your name. Any data we do collect is anonymous and will be used to improve the curriculum. Your anonymous responses may be subject to public disclosure under RCW 42.56.