For the small business owner, tax season can be hair-rippingly stressful, and the prospect of shelling out a load of money to the government is not a pleasant one. To keep your hair in place, you have to be smart with how you tackle business tax preparation. Even though tax season doesn’t officially begin until next year, it’s in your best interest to take a few steps today to prepare your next income tax return. If you want to end the year on a tax-based high note, here are some steps you can take to get ahead of the game.

First things first.

Understand our Washington State tax structure. Washington State does not have a personal income tax. However, it does have a business and occupation (B&O) tax, a gross receipts tax, and a retail sales tax. Familiarize yourself with the specific tax obligations for your type of business and check out the state’s Dept of Revenue Tax Incentive Programs. These include:

- Rural County B&O Credit for New Employees

- High Technology B&O Tax Credit

- Small Business B&O Tax Credit

- Multiple Activities Tax Credit (MATC)

- Credit for Hiring Unemployed Veterans

We believe in your small business acumen but consider hiring a small business tax professional to help you keep more of your hard-earned profits. Over at our Small Business Playbook, we outline how the right tax coach can help you avoid pitfalls.

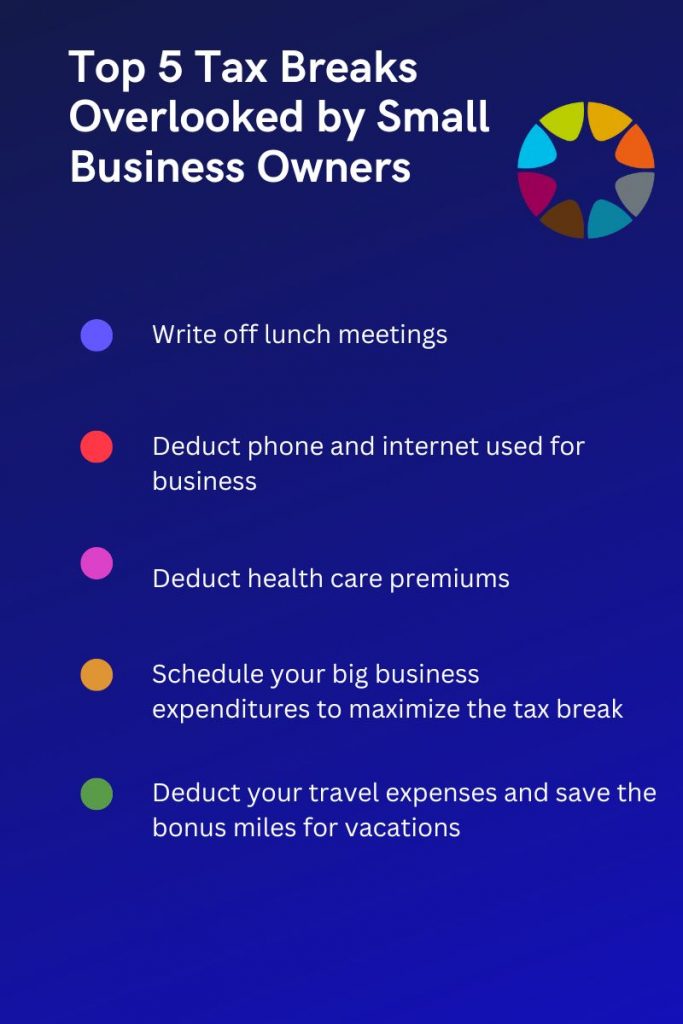

Below are further tax-prep steps you can take to ease the burden of tax season.

Prepare your 2023 Schedule C (Form 1040). Otherwise known as Profit or Loss, or PL statement for your tax attorney. The P & L form contains uniform categories of sales and expenses. The categories include net sales, costs of goods sold, gross margin, selling and administrative expense (or operating expense), and net profit. These are categories that you, too, will use when constructing a P & L statement. Since it is a rendering of sales and expenses, the P & L statement will give you a feel for the flows of cash into (and out of) your business. The P & L statement is also known as the income statement and the earnings statement. Our friends over at the Edward Lowe Foundation do a great job of helping you prepare a P&L Statement for your tax attorney.

Consider making large year-end investments. Purchasing new equipment or certain other business property that will qualify for a Section 179 deduction. If you’re not already familiar with Section 179, it’s a provision in the U.S. Internal Revenue Code that allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. While Section 179 is a federal provision, it generally applies to businesses across the United States, including those in Washington State. It allows businesses to expense (deduct in the current tax year) the cost of certain qualifying assets, rather than depreciating them over time. Under that deduction, small business owners can seek out deductions for all or part of the cost of certain qualifying property in the year you put that item into service. Of course, You only want to make investments that will improve the profitability of the business.

Donate to charity. Many businesses donate a portion of their income to charity. Not only is a donation a noble and important act, it helps reduce taxable income. By donating to charity, you can better your small business’s finances. While money is always a great donation, items like clothes, shoes and toys can also go a long way. Be sure to keep receipts and other documentation to back up your deductions.

File end-of-year-tax forms. While tax forms for your business’s income and operation aren’t due until mid-April, you likely need to submit important forms related to your business and its employees by the end of the year. We do a great job of covering various Washington State taxes and forms, including industry-specific taxes.

We hope these year-end tips relieve a little stress and move you closer to your financial goals.