Lesson 10: Access to Capital

What You’ll Learn: Restarting or rebuilding an existing business is far more capital intensive than a startup. In this lesson, we’ll explore some of the options that may be open to you as a business owner.

Access to Capital

“If Plan ‘A’ fails, remember there are 25 more letters.”

Chris Guillebeau

Introduction

One of the biggest obstacles facing any business, even in good times, is access to capital. Positive cash flow is essential for growth. But how can you find funding when a major disaster has disrupted your operations, and daily receipts are barely covering the basics?

One of the biggest obstacles facing any business, even in good times, is access to capital. Positive cash flow is essential for growth. But how can you find funding when a major disaster has disrupted your operations, and daily receipts are barely covering the basics?

In the old days, it was easy enough to get a stop-gap loan from your neighborhood bank. But those days are long gone in most communities. Large multinational banks are far more risk-averse than a small community bank. Most won’t touch a loan that’s under $50,000, and many companies recovering from the economic meltdown don’t want to take on any more debt than they have to.

As such, businesses have to be very creative in finding alternative sources for funding their operations, whether for short-term capital to reopen or longer-term funding to finance a new enterprise.

Return to Main Office

Courses

First things first

Before you start casting about for an infusion of capital, give a lot of thought to how you can rein in expenses. To paraphrase Elon Musk, “Stop trying to optimize something that shouldn’t even exist” in your organization.

As the years tick by, operations, initiatives and priorities change. Unfortunately, business owners never take the time to step back and question everything from top to bottom to see if they are still essential. The familiar actually becomes a blind spot.

For example, in this age of digital everything, do you really need an accounts payable department? Is a copy center essential? Or even an entire satellite office or distribution center? Things tend to become institutionalized over time, with managers willing to defend outdated operations and entire departments at every meeting. But are those managers even necessary right now? Especially if they are stuck in the past and not looking to the future.

This can be painful. But trimming the fat here and there can help you strengthen your cash flow and slow losses. This includes selling off machinery you don’t need, downsizing your footprint, outsourcing or automating functions such as bookkeeping, marketing or transportation, and restructuring recurring debt, including equipment and facility leases.

Funding Options

Assuming you’ve done all this groundwork, chances are good that you still need access to capital, either long or short term.

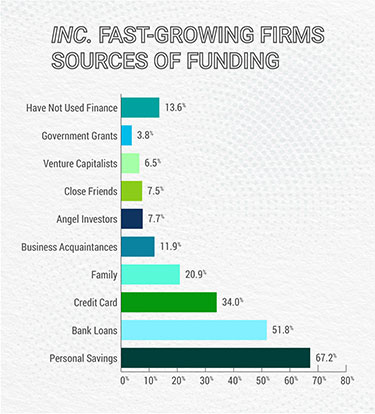

Following are some ways to source additional funding. Many of these are covered in greater detail in our book, Startup Wisdom, 27 Strategies for Raising Business Capital. Even though the book is written with startups in mind, many of the financing strategies can be scaled to a small business.

Spending your own money

While you may have started your business this way initially, this is not something you want to do now. You should never mix personal and business assets. During the pandemic, there have been countless stories of business owners who put their homes on the line to save their business or spent their life savings to keep their doors open. Now they’re faced with a failed enterprise and the loss of a home or a nest egg. It’s far easier to start a business over than an entire life, especially if you’re older. Resist the temptation to put your home, family and financial security on the line. It rarely ends well.

Friends and family

This is another no-no. If you borrowed money from friends and family when you started your business and they are still talking to you, congratulations! Even if you don’t mind them Unfriending you on Facebook, the chances are good that friends and family won’t have the liquid capital to help you stay afloat or expand. The needs of a mature business are far different than a startup, where you’re more than happy to skip a paycheck now and then and call Ramen dinner.

Loans

Even though larger banks may not be an option for you, smaller community banks in rural communities and credit unions may be able to swing a smaller loan for you. Credit unions are there for their customers. If you’ve been a member of one for some time and have a relationship with the manager, they may be your first stop. Before you make an appointment, make sure you know what you’re getting into first.

Do some research on loan terms and interest rates and speak with your accountant or financial adviser to see if you can pass the basic creditworthiness test. The 5 Cs of Credit are: Capital/Cash, Capacity/Cash Flow, Collateral, Character and Conditions. Keep in mind that many loan programs will want you to kick in a portion of the total amount. In some cases, you may have to put up some collateral or hard cash.