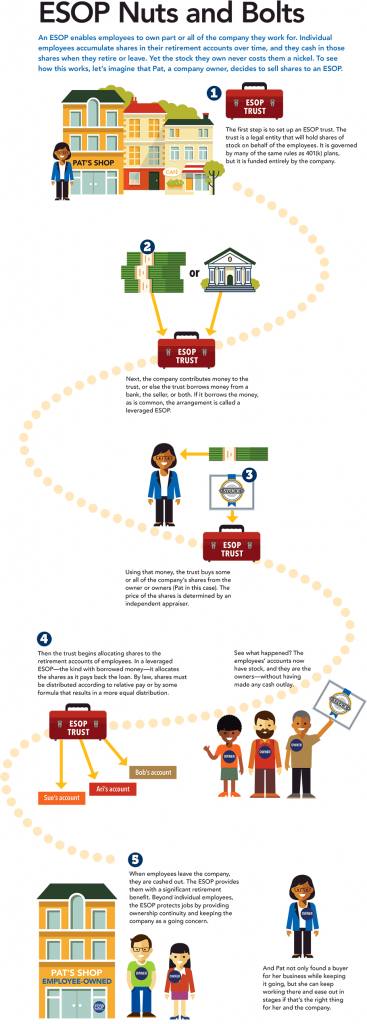

ESOPs are typically created through a pension plan that 1) invests most of the employee’s pension money into the company and 2) workers may borrow against future corporate earnings to purchase additional stock. Money or stock the business contributes to take the plan is tax-deductible.

Pros of ESOPs:

- ESOPs stabilize local economies because ownership stays in the community.

- The transfer of ownership allows the owner to cash out when they retire, knowing the company is in good hands and that all their hard work will go on.

- Employee-owned companies are less likely to lay off workers in economic downturns.

- Employees accumulate wealth through their shares. As such, they have a vested interest in the company’s profitability and growth.

Cons of ESOPS:

- Set up can be complex and expensive, so you’ll need to bring in an ESOP specialist to navigate the transfer of ownership.

- Only corporations can form an ESOP.

If the business is small (fewer than 25 employees), profitable and debt-free, you may also consider a worker-owned cooperative where you sell the business to a group of interested employees through a traditional sale. Alternately, you could sell it to a single employee, such as a member of your management team.

ESOPs are an increasingly popular strategy, so much so that WA State just passed a comprehensive ESOP bill.

There are many different strategies to consider when it comes to employee ownership and retirement planning for small business owners. By working with a financial advisor and exploring all of your options, you can find the best approach for your specific needs and goals.

Head over to our Restart Academy to learn more about ESOPs.