Module 3: Cash Flow

Cash flow explained

To better understand the concept of cash flow and give you a comprehensive overview, we’re going to look at it from three different views:

- Cash Conversion Cycle

- Cash Flow Diagram

- The Wired Cup’s Cash Flow Statement

Cash Conversion Cycle

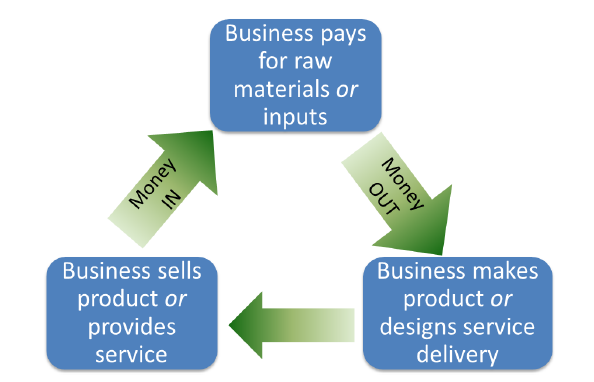

A cash conversion cycle shows how your business dollars are invested in raw materials, resources and other inputs. There are three components:

- A business pays for the raw materials it needs.

- It makes products or services using these materials.

- It then sells these products to a customer.

How fast you turn raw materials into sold goods impacts your cash flow. If you have a short conversion cycle, you sell inventory or services quickly. The cash goes back into the business and can be used for other activities, such as expansion. If goods are sitting on shelves waiting to be sold, your cash is tied up in the inventory, so you can’t use it elsewhere. Ideally, you want to shorten the conversion cycle as much as possible.