Module 3: Cash Flow

Excercise #1: The Wired Cup

This is one of the times that an example is worth 20 pages of explanations. As a business owner, some of this probably looks familiar to you already.

Bob is a new business owner. He recently opened a bakery café known as The Wired Cup in a great location in a small college town. Bob started his business by investing $30,000 of his own money and took out a loan from a commercial bank for $20,000. He spent $45,000 of this to start the business, meaning he has $5,000 left to run it.

The Wired Cup has been a big hit with students, university staff and neighbors from the day it opened. Everyone loves the coffee and the baked goods. He’s even started getting orders from the dean for breakfast goods for the weekly staff meeting.

Still, Bob has concerns. He hasn’t been able to pay himself yet and is wondering when and if he will be able to. The $5,000 he had to run his business is almost gone. Many of his customers are seasonal, going home for holiday breaks and the summer holiday.

Bob wonders:

- How will he pay his bills if there are fewer customers?

- Will he have enough money to ramp up again in September?

- Should he buy in bulk to reduce costs?

- Will his suppliers allow him to buy on credit, or will he still need to pay cash?

The good news is that Bob is already thinking ahead. He has time to find solutions before business slows. As we review The Wired Cup’s cash flow issues, you will be able to apply many of the concepts we cover to your own business.

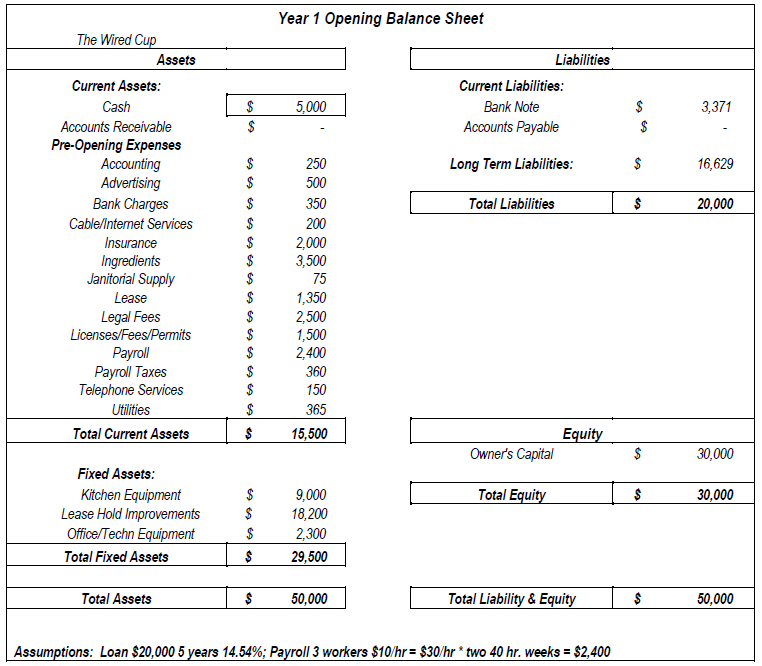

Opening balance sheet for The Wired Cup

Notice that the Balance Sheet has to be balanced. There’s $50,000 in assets and $50,000 in liability and equity, including the money he put in, which shows as “Owner’s Capital” under Equity and the loan he took out under Liabilities. On the left is how Bob has spent the money to date.

Note also that there is an entry that outlines all the Pre-Opening Expenses. These are the expenses you incur as you set up a business. You want to track them separately because financial institutions or investors may consider them as business assets or owner investment/equity.

This opening Balance Sheet tells a story about The Wired Cup. It tells Bob how much money he had to start his business, how he financed it, what he did with the money and what was left over to run the business. Bob’s investment and loan are represented on the Balance Sheet on the right. These are liabilities.

The $20,000 loan needs to be paid back over five years with an interest rate of 10%. If Bob makes the monthly minimum payment due of $424.94, Bob will pay back a total of $25,496.45 to the bank – the original loan plus the interest that has accrued.

This is why debt can be so detrimental to a new business. You have to cover the loan with your payments and the interest, which can be substantial. This will increase your operating costs as long as you own money on the loan, and you can’t use that money elsewhere to fuel growth.

Let’s go back to Bob’s questions. In getting ready to open his business, Bob spent $29,500 on fixed assets such as equipment, materials, signage, seating, etc. and another $15,500 on other items. He has $5,000 left on opening day.

The questions that immediately come to mind from an investor standpoint are:

- Did Bob invest enough of his own money in this venture?

- Did he finance the business wisely? Is he carrying too much debt? Will the loan repayment terms significantly impact his projected cash flow?

- Did he spend the $50,000 wisely?

- Is there enough cash left to run the business? How long will $5,000 last? Three months? Six months?

This exercise aims to show you what a balance sheet tells you about your business. But it is just the first part of the story. Next, we will explore cash flow and how it is used to assess the health of your business and guide its future.