Module 4: Building Credit

Checking your business credit

It’s highly recommended that you check your business credit reports from time to time to identify any errors and correct them, so they don’t affect your business.

- On the Dun & Bradstreet website you can create an account that allows you to view and update basic information on your D&B business credit report and submit up to five disputes at a time. You may log in to your D&B account anytime at no cost. In some cases, you may have to pay a fee to view your report.

- Experian Business, Equifax Business, and Dun & Bradstreet offer paid services for small business owners interested in monitoring business credit scores or adding more specific information to their business profile, such as self-reported expenses.

- Many services are available for monitoring your business credit reports and scores from business credit reporting agencies. For example, some online platforms let you see business credit reports, scores and ratings in a single dashboard. Some may also provide customized recommendations on how to improve your business credit history. Some of these services are free, and some are available for a fee. You should seek expert advice from Small Business Development Centers (SBDCs) or SCORE (an SBA resource partner that provides mentoring to small businesses) counselors to evaluate these resources.

While lenders may use business credit reporting agencies to help them assess risk, they may use other credit scores to make financing decisions. Many lenders use their own proprietary score system that gives more weight to cash flow instead of debt and credit history.

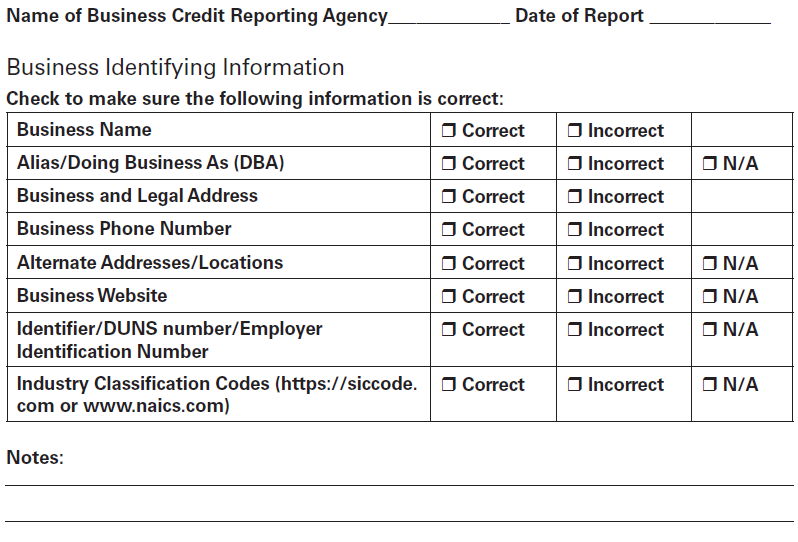

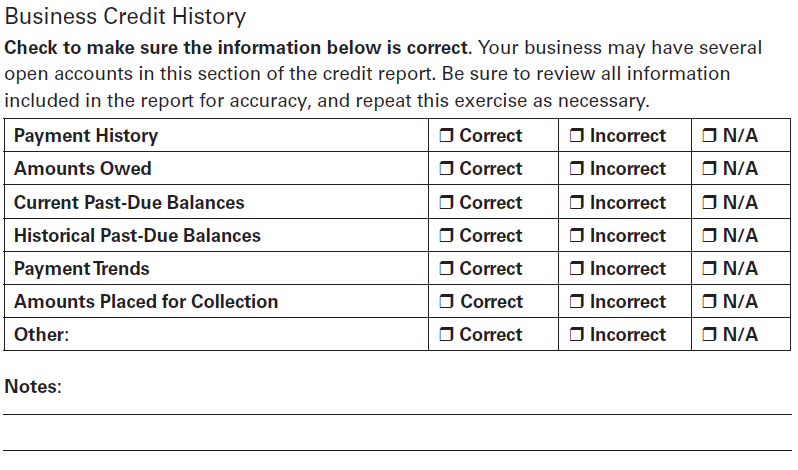

Business Credit Report Checklist

Instructions: Use this worksheet to review each section of your business’s credit report and to identify missing, incorrect or inaccurate information. The items on this checklist may not all apply to your business. In addition, all items may not be reported by every business credit reporting agency.

Download the checklist as a pdf file.

Correcting inaccurate information

If you find something wrong with your business credit report, you should dispute it. You may contact the business credit reporting agency and the creditor or institution that provided the information. Explain what you think is wrong and why, and provide copies of relevant documentation if available.

Experian Business: Phone – 800-303-1640

Dun & Bradstreet: Phone – 866-248-1450