Module 5: Banking Services

Bank products

Banks and other lenders offer small businesses a wide range of business services. As you consider a bank to build a relationship with, use this list of services to guide you in choosing a financial institution that fits your current and future needs:

- Business checking accounts

- Business debit cards

- Savings accounts

- Certificates of Deposit

- Retirement and other employee benefit accounts

- Business credit cards

- Payroll services

- Cash management

- Merchant services

- Wire transfers

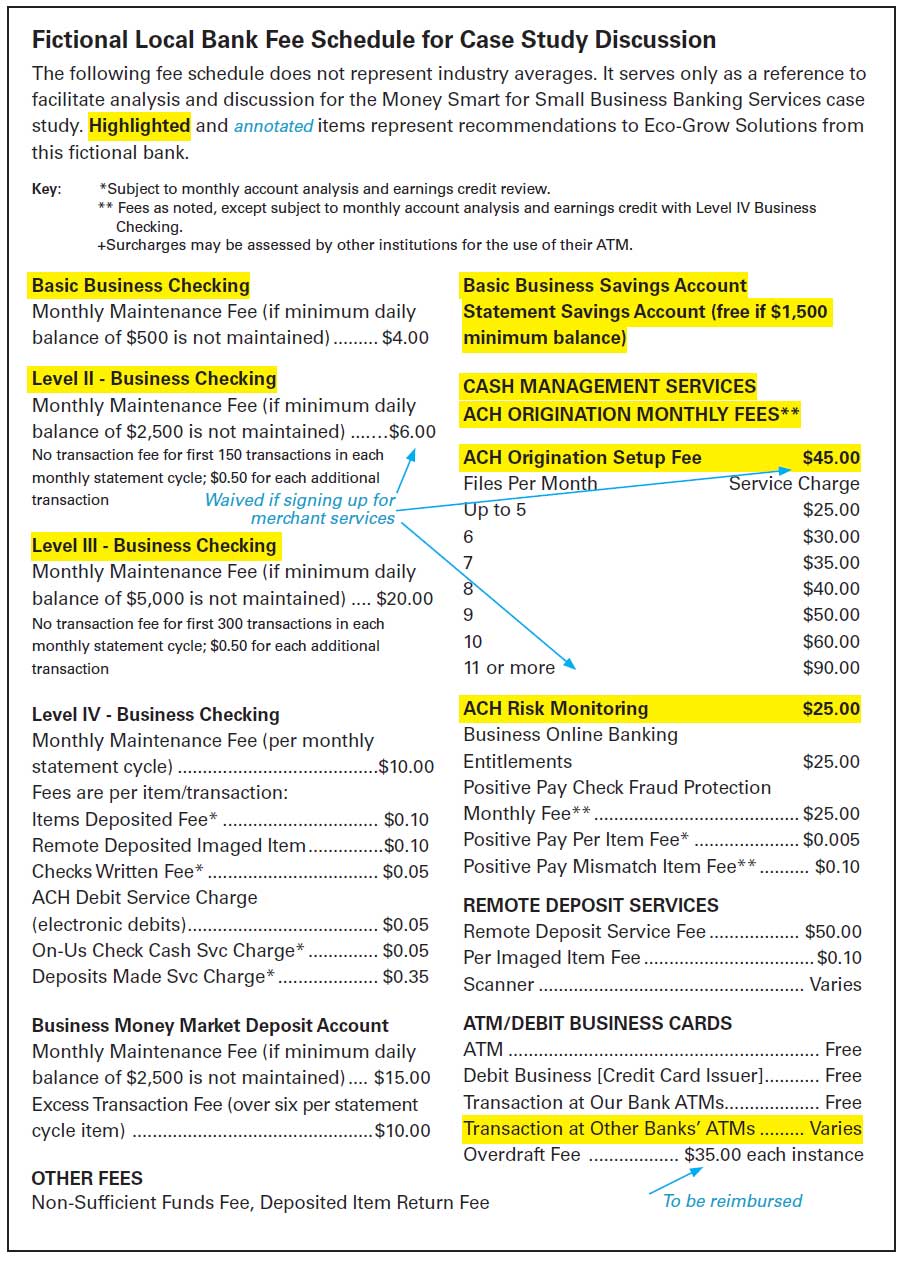

Each of these services may have fees attached to them, whether they are per-transaction fees or monthly service fees.

The bank’s website, brochures or account fee/schedule sheets will outline these fees. You want to ask about discounts or fee waivers for bundled services or keeping the minimum balance above a specific level.

Following is a fee schedule for a fictional bank so you can see the variety of fees banks may charge.

Business Checking Accounts

Banks have different names for their checking accounts. They still fall within these general categories, though slight differences may exist.

Small Business Checking Account: This type of checking account is otherwise known as a flat-fee account. It is a type of checking account the offers you a limited number of fee-free transactions each month. This may include a limit on the number of deposits made or checks written. This is fine for many small businesses, especially those that use electronic payment methods for vendors and suppliers and batch deposits. This account usually has a lower minimum balance requirement than a commercial checking account.

Commercial Checking Account: This type of account is designed for larger businesses with a high volume of transactions. This requires the business to have a higher minimum balance and is a type of account a small business would move to as they grow.

Business Debit Cards

Business debit cards allow you to make withdrawals from your business checking account using a card that works much like a credit card. Some banks may place limits on the amount of cash you can withdraw from an ATM, but these cards come in real handy for purchasing and tracking purchases without having to carry a lot of money. Just remember that these cards act like cash. The amount you withdraw from your account is usually deducted immediately. If you don’t have sufficient funds, the purchase may be rejected at the point of sale. Review the risk with your banker before you get additional cards for other company employees. You may want to consider purchasing prepaid or preloaded cards instead to limit the amount of funds that others can spend without your prior approval.

Business Savings Accounts

Savings accounts can usually be tied to your checking account, allowing you to earn a little interest on your money as it flows in and out of your business. It is also an excellent way to set aside funds to pay your taxes and save for a rainy day. If you have a surplus of funds that aren’t needed near term, you can also move some of your savings account funds into a certificate of deposit (CD), which allows you to earn even more money through higher interest rates. You can determine the length of time this money is set aside. Some CDs are for only a few weeks; others can have a term of several years. Mixing and matching the length of terms can help you balance your cash flow needs against the higher rates that are usually offered with CDs.