Module 2: Recordkeeping

Legal compliance

As an owner, you probably execute contracts and hold various licenses and permits. If you employ workers, you probably also have payroll to track and report for tax purposes. Because these relationships have long-term legal compliance implications, keeping accurate records for each is important to you should you be audited or have a legal claim made against you.

Contracts, leases and other agreements

Keeping good records of contracts is particularly important. Not only may you need to refer to them during the contract period to make sure everything is being completed as agreed, but you may need to refer to them years down the road if something goes awry that was covered in the agreement. The same is true for leases and other legal agreements between you and another party. Before any work begins, make sure you have the original signed copies of the agreement. If your contractor or landlord needs an original, prepare two for signature.

Licenses and permits

Nearly every business needs licenses and permits to operate. These may be federal, state, county or local permits or licenses, including:

- Business license

- “Doing Business As” (DBA) statement

- Seller’s permit

- Home occupation use permit

- Food preparation permit

- Licenses or endorsements related to a profession, such as an accountant, architect or contractor.

Make sure you keep these licenses and permits current. In some professions, you may need to show these to a customer. Create a system that allows you to renew licenses and permits before they expire. This will reduce the chance you will need to pay penalties, fines or face other legal action.

Payroll and personnel

If you have employees, you must keep proper records on them to comply with local, state and federal legal requirements, including worker’s compensation and unemployment insurance. If you have a lot of employees, you may want to hire a payroll service to manage these functions for you. They can also provide you with some expertise on what records you need to keep, which may be considered confidential, and the various taxes you will need to pay.

Following is a short list of some of the things you may need to track:

- Hiring and evaluation documentation

- Basis on which wages are paid

- Social Security Numbers

- Total hours worked

- Additions to or deductions from wages

- Total wages paid each pay period

- Income tax withholdings

- Fair Labor Standards Act required information

- Injury reports

- Employment Records

- Copy of annual performance evaluations

In addition to speaking with your accountant or payroll service, you may want to review IRS Publication 15, “Circular E, Employer’s Tax Guide.”

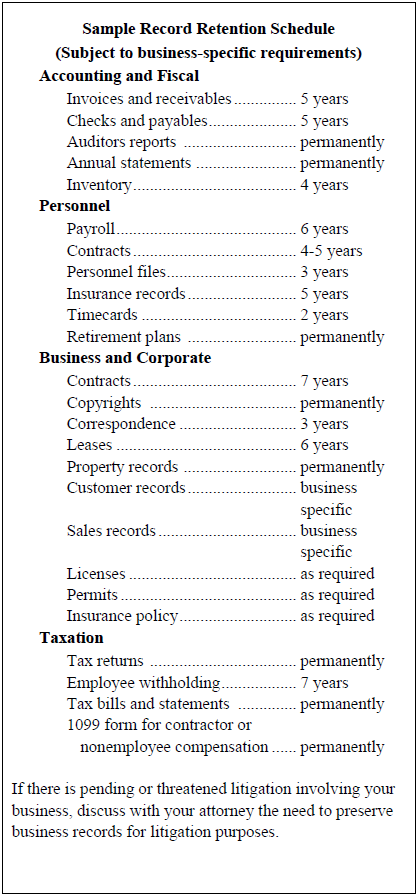

Records retention

Some records need to be kept longer than others. As you set up your records retention plan, you want to keep this in mind as you create a storage and retrieval system, either a paper-based one, one on your computeror one stored out in the computing cloud.

The Internal Revenue Service determines some of these guidelines. State agencies or local governments may have additional retention requirements. But for now, let’s stick with what the IRS requires:

Again, your accountant should be able to give you a more accurate picture of the recordkeeping requirements for your type of business and location.