Module 1: Financial Management

Financial statements

Financial statements give you a solid overview of your business and its relative health. There are three statements you should pay close attention to:

- Balance Sheet

- Cash Flow Projection – also called a Cash Flow Statement

- Profit and Loss Statement (P&L) – also known as an Income Statement

These are your primary decision-making tools. They tell you a story about your business and answer such important questions as:

-

- Can this business generate cash flow?

- Where is the cash coming from?

- Is the available cash being used wisely?

- Is the business capable of paying back its loans?

- Is the business capable of taking on more debt or loans?

- Are there any trends occurring in the business that could be signs of trouble?

- Is the company profitable?

- How quickly does this business turn over inventory?

These three reports can be generated automatically if you use an online bookkeeping service or software.

Let’s take a closer look at each and how they function.

The balance sheet

A balance sheet is a snapshot of a business at a specific point in time that gives you an overview of your assets, liability and your equity. Typically, you will want to review your balance sheet at least monthly and certainly quarterly.

On the one side is your assets: cash, accounts receivable, inventory, investments, land, buildings, equipment, etc. On the other side are your liabilities; the debt or obligations that must be paid, including any outstanding loans, taxes, business accounts due (for inventory, products, etc.) and any other costs you must pay as part of running your business. Equity is what came from you, not your creditors. This includes your owner’s draws (think of this as your paycheck) and any cash you have put into the business yourself.

A balance sheet can also tell you who has control of your cash, equipment and inventory. For instance, if you have creditors you are making payments to, they own part of your assets.

This is not unusual, by the way. It is hard to build a business without borrowing money, whether it’s extended payment terms with suppliers or vendors or money a bank has loaned you. Since lenders use balance sheets in reviewing a credit application, the more assets you own, the greater the chance of getting a loan

You will want to close the balance sheet at the end of an accounting period (a quarter or year). This means that everything in it is locked and final. This closing process will allow you to compare balance sheets. Think of each balance sheet as a snapshot in time. You can use them to compare your performance from quarter to quarter or year to year.

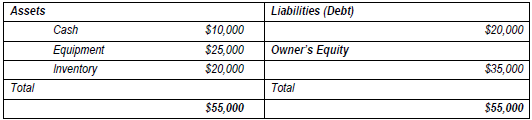

Let’s look at a very simple balance sheet:

On the right side is the amount of money the owner has invested. There is $35,000 in owner’s equity – the money she invested in her business – and an additional $20,000 in debt that she borrowed elsewhere. This adds up to a total of $25,000 in liabilities (debt), i.e., the part you need to pay yourself back as well as the amount you need to pay back on the loan.

On the left are the assets. This is how the money was used to start the business. She spent $25,000 on equipment, $20,000 on inventory and has another $10,000 available as cash, which can serve as working capital for other expenses.

Again, this is a very basic balance sheet. You will have more line items on each side of your own balance sheet.

Note: Each side of the balance sheet must balance. The total on both sides – assets and liabilities – must add up to the same amount.

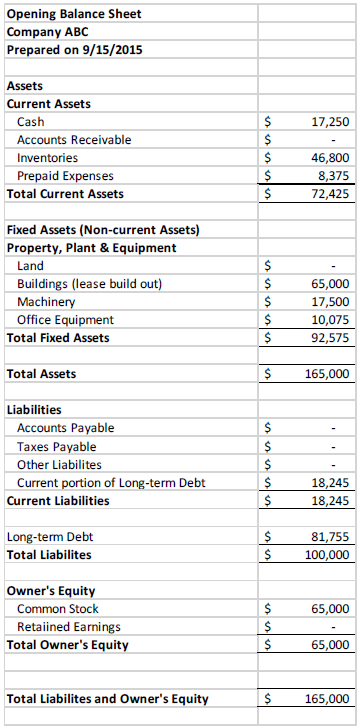

Here is a more detailed balance sheet that reflects the more complex needs of a typical small business. Even though there are far more categories and entries, the assets and liabilities add up to the same number.

Determining your business’ liquidity

A balance sheet has one more trick up its sleeve. It can help you know if you have sufficient money on hand to pay employees or other obligations when they come due. This is known as liquidity. It is an assessment of your company’s assets compared to its liabilities.

There are several different ways to think about liquidity:

- Working Capital: This is the amount of current assets minus the amount of current liabilities.

- Current Ratio: This is the amount of current assets divided by the amount of current liabilities.

- Quick Ratio: This is the same as the Current Ratio, but you remove the prepaid expenses (advanced payments for goods or services to be received in the future) and inventory out of your current assets. This is also known as the acid-test ratio.

These formulas allow you to look at your company’s health from different views.

If you’re going to seek long-term loans, you can use some other formulas to assess load readiness. Ideally, you want to have a low level of risk. A company with too much debt, especially long-term debt, may be considered high risk by lenders.

- Debt to Equity Ratio: This compares your business’ total debt (current liabilities + long-term liabilities) to the amount of stockholder’s equity (i.e., the part of the company under your control and not a debtor or lender).

- Debt to Total Assets Ratio: Compares your business’ total debt to the total amount of its assets.

There’s no need to give this too much thought at this point in your mastery of financials. These are terms you may hear from time to time, so it’s good to get them out of the way before we move on.

Remember that your balance sheet focuses on tangible assets. You may have intangible assets as well, such as copyrights, trademarks, patents, etc. These don’t appear on the balance sheet until you lease or sell them to another business. The same is true of other intangibles such as unique research you’ve performed, customer loyalty, marketing strategies you’ve developed, etc. They have value, but they are not factored in until someone else acquires them.

A balance sheet is an important tool in your financial toolbox, as are cash flow projections and profit and loss statements, which we will look at next.