Module 1: Financial Management

Budgeting

Let’s start with one of the most essential skills: Budgeting. A budget is a list of all your monthly or yearly expenses, organized into categories.

A budget will help you:

- Effectively track all your business expenses

- Plan deliberately for the future

- Show you where you can reduce costs if you need to

- Plan for expansion

- Make a profit

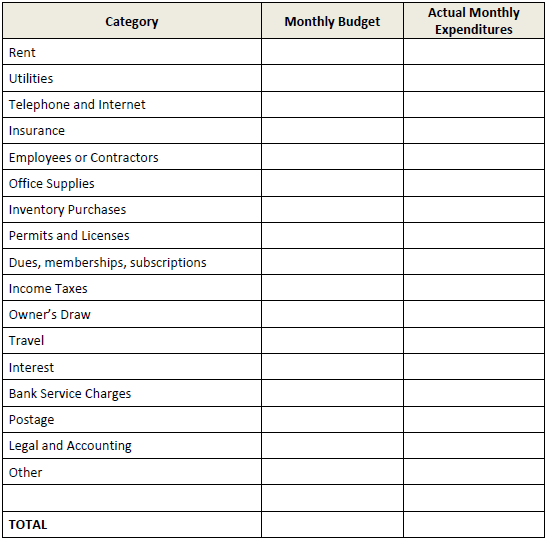

Here is a chart showing the most common budgeting categories. If you have a bookkeeper or accounting software (more in that in a bit), you can easily customize the categories to match your specific business needs.

Feel free to take a few minutes and create a budget based on what you already know about your business. It’s O.K. if you make some guestimates. This exercise will help you get a feeling for what money is coming in, what’s going out, where it’s going and what money you have at the end of the month.

Eventually, you’ll want to convert any guesses into actual dollars spent. You can then compare the total at the bottom with the income you’re bringing in each month. Be sure to base your budget on your desired spend, not the dollars you’re spending currently. The budget vs. your actual monthly expenses will tell you where you need to reduce costs, reallocate dollars from another category or increase prices to compensate.