Module 1: Financial Management

Profit & Loss (P&L) statements

The last of the financial statements you need to understand is the profit and loss statement, or P&L. It is the best way to measure if your business is profitable since it measures revenue and expenses over the period of a month, quarter or year. Most of your critical financial decisions will be based on your profit and loss statement, which will provide you with accurate, actionable information to grow your business with minimal risk.

Basic formula for P&L statement

The basic formula for a profit and loss statement looks like this:

+ Sales

– Cost of Goods Sold

= Gross Profit

– Overhead

+ Other Income

= Net Profit

- Sales (also called Income or Revenue) – is the total amount from selling your product or service during a specific time period.

- Cost of Goods Sold – is the total expenditure for inventory items that customers buy, including the cost of purchasing the items, freight, manufacturing costs, modification costs and packaging. If you offer services, the Cost of Goods sold is the cost of providing the services, including labor, materials used and transportation.

- Gross Profit – sales less the cost of goods sold.

- Overhead – expenses associated with your ongoing business operation such as payroll, rent, insurance, interest, legal fees, utilities, etc.

- Other Income – can be non-recurring sources, such as rebates or interest paid.

- Net Profit – is gross profit minus overhead. Net Profit is what remains to pay for expansion, equipment, loan repayment, income taxes and owner’s draw.

Compiling a P&L statement

If you’ve set up a bookkeeping account online or purchased software to handle your accounting, then the P&L statement will generate automatically at the push of a button. You’ll want to print it out and make time to study it regularly, as it will help you build accurate cash flow projections.

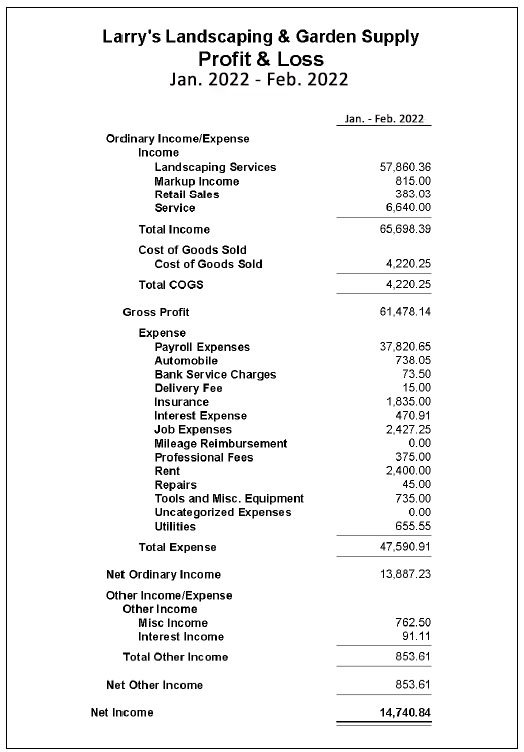

Let’s look at a sample of a profit and loss statement:

Breaking it down into our formula, here is how the company arrived at its net income for the period.

+ 65,698.39 (Sales)

– 4,220.25 (Cost of Goods Sold)

= 61,478.14 (Gross Profit)

– 47,590.91 (Overhead)

+ 853.61 (Other Income)

= 14,749.84 Net Profit