Module 1: Financial Management

Cash flow

Cash flow can be considered in two ways –

- It can be the balance of cash received minus the amount of money paid out over a period of time – or –

- The movement of cash in or out of your business

A cash flow statement will provide you with an overview of both. It is a historical report, not a real-time one. It is used to see if projected cash coming in (inflows) will sufficiently cover disbursements (outflows). What many business owners don’t know is that you can actually run a profitable business and still run out of cash because of too much liquidity. Money may be coming in, but you’re spending more than you’re bringing in because you’re servicing too much debt or you have too much overhead.

A cash flow projection will help you set sales goals and plan for expenses that support sales. It will help you determine the breakeven point as you start your business or expand it. For example, if you need a new piece of equipment or a larger space, a cash flow projection will help you figure out how to pay for it. It can also identify cash shortages that may not have shown up in your profit and loss statement.

Cash flow projections in action

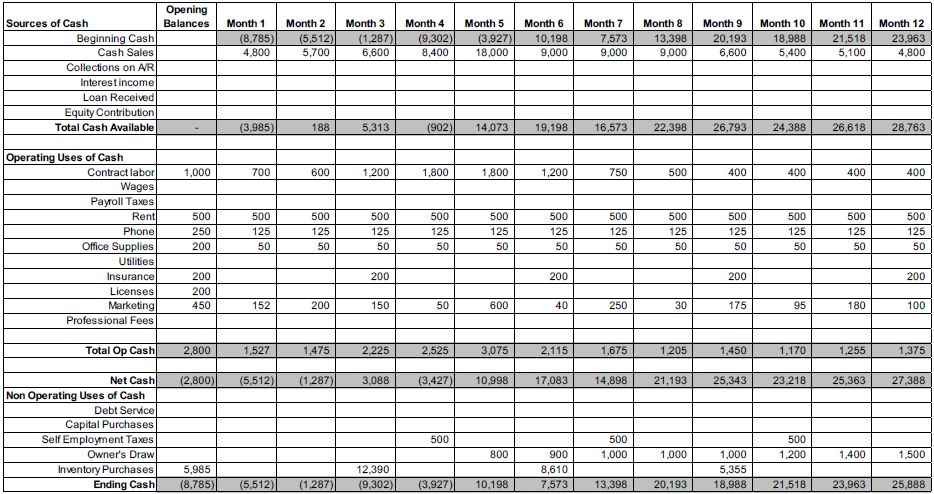

Let’s start by looking at a sample cash flow projection.

The first set of rows – Sources of Cash – document all the sources of incoming cash, including cash from customer sales, interest earned, loan funds and current checking and savings account balances.

The second section – Operating Uses of Cash – contains all the expenditures you have related to the day-to-day process of buying and selling services and goods. Most of these expenses will also appear in your profit and loss statement, which we will look at next.

The last section – Non-Operating Uses of Cash – shows the expenses that generally show up on your balance sheets, such as equipment purchases, the principal portion of any loans (not the interest), inventory, taxes and your owner’s draw.

If you are using software or an online platform, the math portion of cash flow happens automatically when you generate a report. The basic formula to calculate cash flow is to subtract your Uses of Cash from your Total Cash Available. This will give you the Ending Cash for the month, which serves as your Beginning Cash for the following month.

Before we look at a detailed Cash Flow Projection, let’s see how you can strengthen your positive cash flow if it seems to be underperforming:

- Increase the number of items sold.

- Increase the price of items.

- Reduce expenses.

- Change the timing of expenses.

- Save money to have sufficient Opening Cash to get through the “start-up” period.

- Obtain sources of cash other than sales, such as a line of credit.

- Reduce or change the timing of your owner’s draw.

- Research vendor options for buying inventory at a lower price or obtaining credit from vendors.

- Establish policies to get paid sooner from customers.

Sample cash flow projection