Module 4: Building Credit

Sample personal credit report

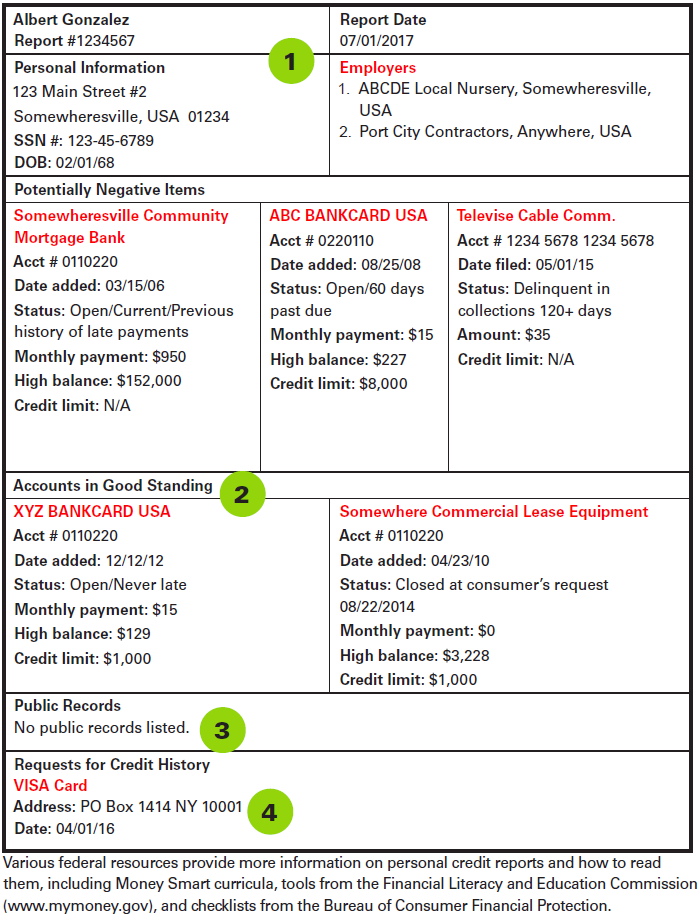

If you haven’t seen a credit report before or reviewed yours in a while, here’s a basic sample showing what’s included in a typical credit report.

A personal credit report has four main sections:

- Personal or consumer information (e.g., name, addresses, and employment).

- Credit account summary, including creditor information, account status, amounts owed, account type, and history.

- Public record information (e.g., bankruptcy or foreclosure).

- Inquiries that have been made to review your credit history.

Disclaimer: This sample does not include everything that you will find in an actual personal credit report. It is for training purposes only.

Building a solid personal credit history

In addition to ensuring that your credit reports are accurate, consider the following to improve your scores:

Pay your loans and other bills on time. As we have learned, repaying credit accounts on time is the most significant factor in increasing any credit score. If you have had trouble with credit in the past, you can rebuild your credit history by paying what you owe on past-due accounts.

Minimize how much you owe in relation to your credit limit. Low credit utilization shows that you are not overextended with your debt obligations. For example: if you are using $1,300 of your $2,500 in available credit, your credit utilization is 52%.

Pay off outstanding collection accounts and other debts that could lead to legal action.

Avoid negative events such as bankruptcy or foreclosure, which make it difficult to obtain business and consumer credit and will be reported in public records.

Comparison shop for a mortgage or car loan within a limited period (no more than 45 days). Think carefully before applying for new financing. Because hard inquiries of your credit negatively affect your credit score, determine if the loan is essential.

Maintain a mix of installment and revolving credit accounts. This shows lenders that you can manage different types of credit successfully. You do not have to carry much if any, outstanding debt. For example, you can use a credit card once each month for basic household purposes but pay it off in full every month. The Banking Services module provides details on types of loans and financing options.

Do not close old accounts or those that have been paid in full. This can lower your available credit limit, leading to an increase in credit utilization on your remaining accounts that could hurt your personal credit scores. If, however, you are paying fees for an account that you do not need or use, it may make financial sense to close it.

When personal credit history is important to your business

Personal credit can be important at various stages throughout the lifecycle of your business but may be particularly important when you are:

- Establishing a new business.

- Personally guaranteeing or cosigning a business loan.

- Accessing financing to grow an existing business.

- Obtaining trade credit from suppliers of inventory or raw materials before receipt.

- Qualifying for other business opportunities, such as government contracts.

If your business is new, there will be no credit history under your business name. As such, your ability to secure loans or access credit will be based on your personal credit history.

In most cases, a lender will require you to guarantee a loan or other financing product (such as a line of credit) for your business. As the one guaranteeing the loan, you become personally liable for the debt even if the business cannot make payments. Consider the risk of loss and the terms of such a guarantee carefully.