Module 4: Building Credit

Credit reporting and your business

As a business owner, your personal and business credit histories can create new opportunities for your business or severely limit your options.

When you apply for financing, lenders, vendors and suppliers will review your personal and business credit history. This review helps creditors assess the risk of lending you money and determines the terms, such as the length or amount of the loan or the interest rate you are charged for the privilege of using someone else’s money.

Unpaid personal debt can lead to a business loan application being denied. This is especially true with a new business or a business that’s only been around for a year or two.

Credit reporting can also benefit your business operations by helping you assess and reduce risk. For example, you may want to request a credit report for a potential business partner or customer to determine the risk of extending them credit.

Defining credit

There are many definitions for credit, but we want to narrow the focus in this module to credit as it relates to owning and operating a business.

Credit is the ability to borrow money based on a promise that you will pay it back. Car loans, credit cards, small business loans, and a home mortgage are all types of credit.

Two basic types of credit impact your ability to get a loan or financing for your business. Your personal credit history is a record of your use of credit that is reported to credit reporting agencies. These agencies use your credit history to generate a credit score, which rates your creditworthiness. Your business credit history reflects your business’ history of handling debts and financial obligations. These activities are reported to business credit reporting agencies.

Having strong personal and business credit histories can support the growth and viability of your small business by helping you:

- Access financing to start or expand your business.

- Acquire raw materials and inventory.

- Invest in equipment, materials, vehicles and market expansion strategies.

- Borrow money to address temporary shortages in working capital, such as when you need to order inventory for the upcoming sales season.

Building business credit

There are many definitions for credit, but we want to narrow the focus in this module to credit as it relates to owning and operating a business.

Credit is the ability to borrow money based on a promise that you will pay it back. Car loans, credit cards, small business loans, and a home mortgage are all types of credit.

Two basic types of credit impact your ability to get a loan or financing for your business. Your personal credit history is a record of your use of credit that is reported to credit reporting agencies. These agencies use your credit history to generate a credit score, which rates your creditworthiness. Your business credit history reflects your business’ history of handling debts and financial obligations. These activities are reported to business credit reporting agencies.

Having strong personal and business credit histories can support the growth and viability of your small business by helping you:

-

- Access financing to start or expand your business.

- Acquire raw materials and inventory.

- Invest in equipment, materials, vehicles and market expansion strategies.

- Borrow money to address temporary shortages in working capital, such as when you need to order inventory for the upcoming sales season.

How personal and business credit work together

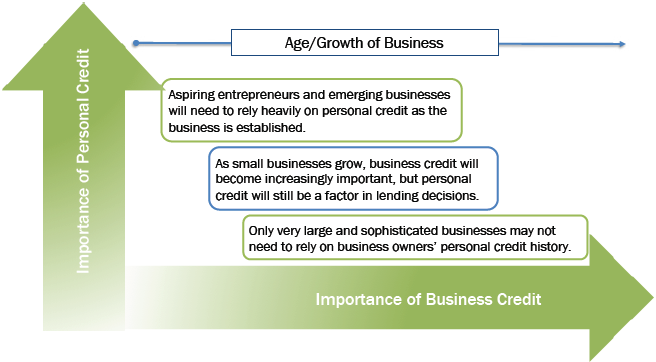

If your business is new, lenders will want to review your personal credit history to decide on any business loan application. Lenders view your personal credit history as a good indication of how you will manage your business finances and pay back any loan.

When you start a business, you will want to create a credit history for it that is separate from your personal credit history. This may mean getting a corporate credit card from your bank or securing credit terms from vendors or suppliers so you can start demonstrating the business’ ability to manage credit and make payments.

As your business matures, this history of credit will become meaningful. The people who approve the loan – the underwriters – will begin to place more weight on your business credit history than your personal one. This opens the door to larger loans with more generous terms.

To maximize your chances of success, it’s important to understand how you can build a solid personal and business credit history.