Module 8: Risk Management

Identifying risk

One of the most important investments you can make in your business is to create a business plan. A thorough plan will help you assess different types and levels of risk, especially those that may impact your ability to keep your business open and growing.

Your plan needs to address the continuation of your business because of a specific risk. You want to look for anything that can halt, slow or affect the profitability or viability of your business. These risks should be listed in order according to their possibility, impact and cost. You want to create two different buckets for risk. In the first bucket are the things you can control, the internal risks. The second bucket has the things that can affect your business, but you have no actual control over them.

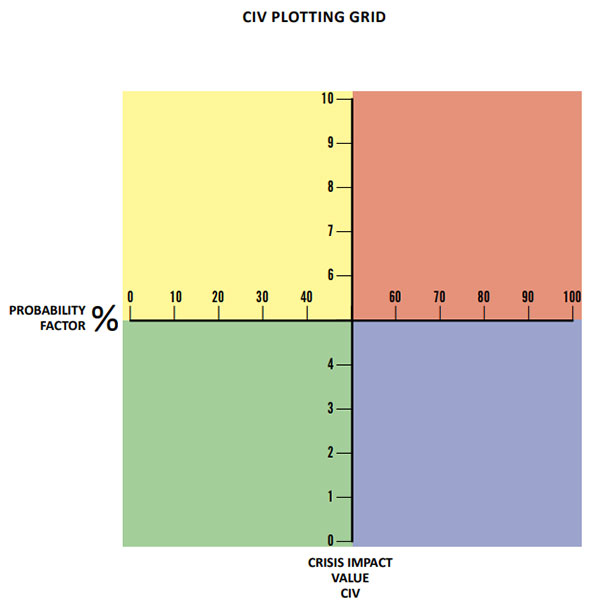

An excellent way to map all this out is on a crisis planning grid, which looks something like this:

You can learn more about this tool in the crisis planning toolbox available in our Disaster Planner.

In a nutshell, you want to identify those events map out to the red zone. They have the highest possibility of happening and the most significant impact on your business. You want to either reduce the likelihood they will happen (the ones you have control over) or reduce the impact of such an event on your business. This exercise can be used for any number of risk management exercises.

As you think about potential risks, you may find it helpful to speak with other business owners. They may have additional insights or experiences to help you assess your own business risks. And remember, any plan is good if it is updated regularly, not placed on a shelf to gather dust.

Warning signs

Owning a business means that you need to be alert at all times to potential risks. Even if you identified risks and taken steps to minimize their effect, new risks can creep into your business in ways you never imagined.

Here are some of the warning signs of increased risk

Excessive debt compared to owner’s equity

Use the following formula to calculate your company’s debt-to-equity ratio:

First, you want to add up your total liabilities, including any short- or long-term obligations such as lines of credit, loans, credit cards, etc. Then you divide this number by your total equity, which should appear on your company’s balance sheet.

Generally, your debt-to-equity ratio should not be above 40 to 50%. If it is higher, your business may have an unhealthy or even fatal level of financial risk.

Reliance on small numbers of customers, products and vendors

Your business needs to continually reach out to new customers to replace any existing customers who stop buying from you. Relying on a small number of customers, even if they are high value, puts your business at risk. The same can be said for vendors. Depending too much on a single vendor or a few vendors can create risk. As we’ve seen in the pandemic, a disruption to the supply chain can mean that your source of goods dries up, and you don’t have an alternative to turn to. The health of your supplier’s business can have a profound impact on your business, increasing risk.

Cash flow issues

We’ve explored the importance of cash flow in Module 3. If your expenses are consistently greater than your income, you need to make adjustments. Ideally, your business should always have a positive cash flow. If you are having a hard time making ends meet, such as experiencing an increase in overdrafts in your bank account, you have a cash flow problem that needs to be resolved immediately.

Irregularities in accounting, bank or timecard records

Spot checks of your accounts may uncover errors or even fraud. As you audit your accounts, you want to ask these questions:

- Do project or time sheets match what has been submitted for payroll?

- Does the payroll ledger reconcile with your bank account statements?

- Are there outstanding checks to former employees?

- Do former employees still have access to your accounting system?

- Are there any unusual logins or attempts to access your accounting platform?

Irregularities in computer system reports

To reduce the risk of computer hacking, fraud or phishing attempts, you’ll want to:

- Review access levels and privileges and determine if employees granted access still need it.

- Remove all employees who are no longer with the company.

- See if there have been any changes or additions to the list of employees granted access to a particular system or computer.

- Review any access to your systems outside of ordinary business hours that are irregular and need follow-up.

Employee turnover rates

As you review your records, assess the risk of excessive employee turnover. If you have a high rate of turnover, or if turnover has suddenly increased, ask yourself if it’s the result of a competitive job market, poor hiring decisions, lack of training, misaligned job descriptions and roles or a toxic work environment. Any one of these factors can expose your company to increased risk.

Evaluating risk

Minimizing and controlling risk can improve operations, protect business cash flow and help you become more resilient. Cash flow is everything in business. It enables you to sustain credit relationships, build new credit, make it through tough times, and give you options.

This means your business will be more stable and will be able to weather nearly any challenge that comes its way. Good cash flow means stability which increases your creditworthiness which leads to longevity.

As you guide your business forward, make risk management part of your routine. New risks arise all the time, and you want to be aware of any new threats to your business. Likewise, some risks lose their pertinent. Engage others in your business as you grow. As the boss, you can’t possibly see everything and know everything. Create a work environment where your team feels comfortable surfacing issues that may put your business at risk.

Periodically, you’ll want to do a SWOT analysis to identify your strengths, weaknesses, opportunities and threats. This is an excellent exercise for your managers as it is a candid assessment of your business. And remember, some risks can also be opportunities.