Module 4: Building Credit

Credit inquiries

There are two types of credit inquiries: hard and soft.

A hard inquiry occurs when you apply for credit. These inquiries account for about 10% of your credit score. Too many hard inquiries and your credit score can drop since it looks like you’re seeking more credit than usual. A credit report can show up to two years of these inquiries. Utility companies make these types of requests, and if you’re cosigning for a loan, this will also show up on your report as a hard inquiry and potentially lower your score.

Soft inquiries occur when you or others merely check your report for informational purposes. For instance, a potential employer may conduct a soft inquiry. A lender who wants to preapprove you for a credit card offer may also make this type of inquiry. These do not affect your credit score, and only you can see them. Creditors cannot.

TIP: If a lender requests information about something that may or may not appear on your credit report – such as unpaid parking tickets – be sure to respond truthfully. These outstanding items may appear before the closing date of your loan, and failing to disclose them, or worse, lie about them, can be grounds for denying your loan, even if it was tentatively approved.

Understanding credit scores

Your credit score – sometimes referred to as a consumer credit score – is based on the information that appears in your credit report. It is a number that helps lenders and creditors determine your credit risk, the risk that you won’t make timely payments or default on the loan.

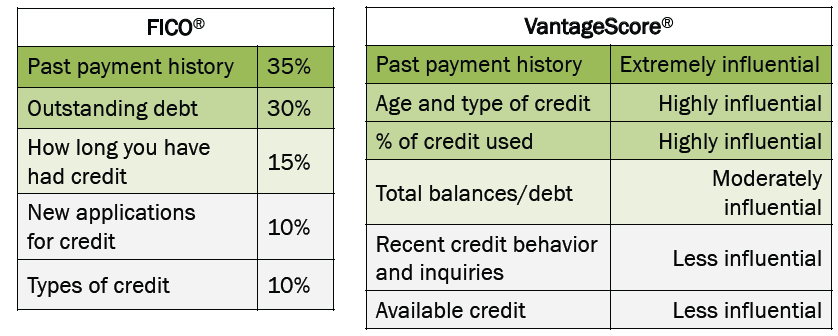

Lenders may use one or more credit scores to make a lending decision. Lenders may generate the scores themselves or use a score calculated by another company, such as a credit reporting agency. Credit scores are modeled after two different methods of weighing creditworthiness and risk. Knowing how these scores are calculated and weighted can help you improve your personal credit scores.

The two methods commonly used are:

These two scoring models are calculated in different ways, but they generally use a score range of 300 to 850. Knowing how the scores are calculated can help you understand how to build or improve your personal credit scores.

- Payment history is the most critical factor in FICO® Score and VantageScore® calculations. That is why it is vital that you make payments on your bills on time.

- Outstanding debt, particularly the percentage of credit used (or credit utilization), is another crucial factor in calculating these credit scores. That is why it is important to avoid keeping high balances on credit card accounts or maxing out any revolving credit account.

- Other factors that influence your scores include the length of your credit history, how often you have applied for credit, and how many and what types of credit products you are using.

The weight of the credit score in evaluating your request for credit varies greatly by lender.

What is a good credit score?

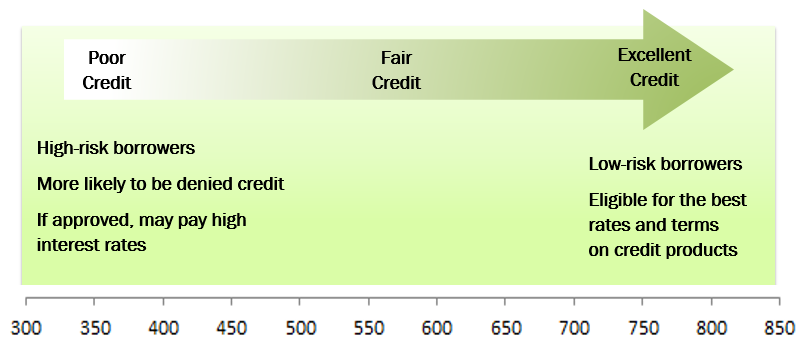

In general, the higher the credit score, the better. This means you will be a better borrower in the eyes of the lender and will be offered more favorable terms and lower interest rates. If you have a low credit score or no score at all, you may be denied a loan altogether, or you may have to pay a higher interest rate.

For those with “fair” credit, you may qualify for some loan products but not for the lowest interest rates. Another material factor for loan approvals is the borrower’s debt-to-income ratio, reflecting the amount of income available to make loan payments.